Hi PPM practitioners! I am an architect in the CA Services PPM practice, and former CA customer. Over the years, I have been amazed that many of my fellow practitioners shy away from implementing financial management, thinking that it is too complicated or that they are not that savvy about financials. That’s why I am writing a series of blogs to take some of the mystery out of CA PPM Financial Planning and unravel the perceived complexity.

In this initial blog, I will define PPM Financial Planning’s core capabilities. This will give you a sense of where to start your journey. In later blogs, we will explore the capabilities in further detail (the good, the bad and the ugly).

The Basics

It will simplify things to break down PPM Financial Planning into 5 basic pillars, along with a supporting setup structure. This will help you figure out which core capabilities are more critical to your organization's desired outcomes and establish a maturity roadmap. In this post, I’ll assume that you are ready to move beyond the general financial cost/budget on the investment’s financial summary page to explore the value-added capabilities of CA PPM Financial Planning.

Pillar 1 - Investment Cost

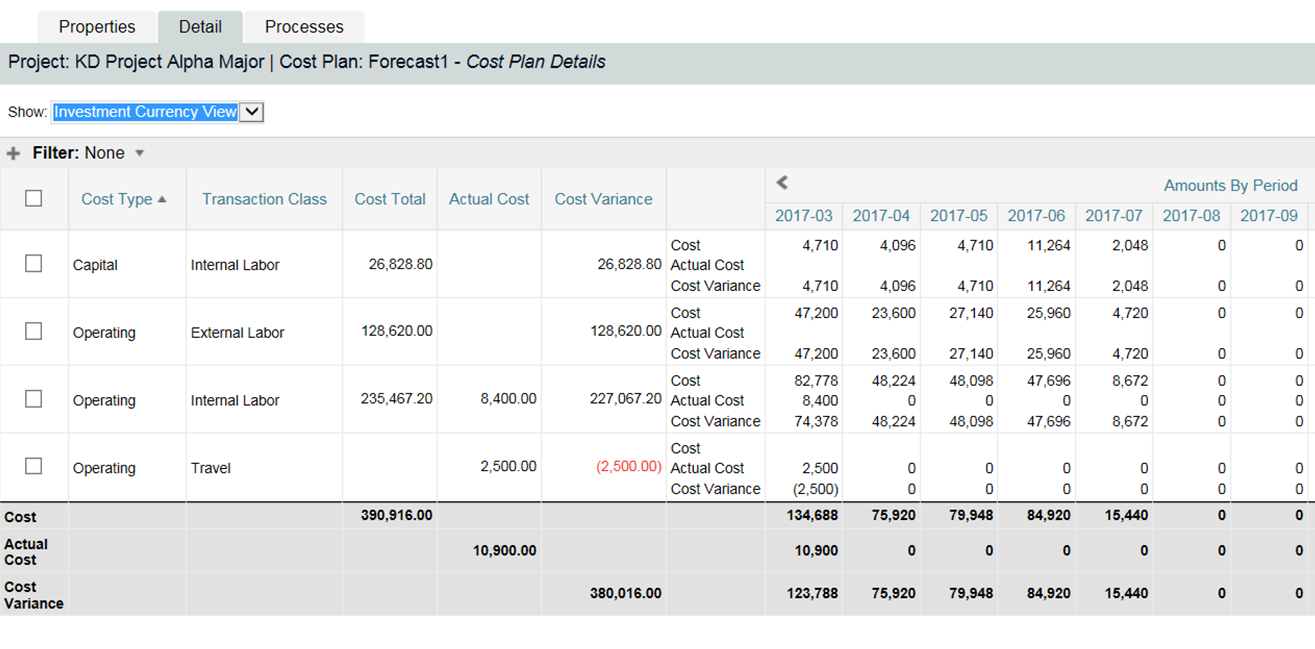

Pillar 1 is about planning and tracking the cost of your investments. The major sub-components are forecasting, budgeting, benefit planning, and capturing actual cost. At a minimum, I suggest you plan/forecast the expected cost of your investments (projects, applications, assets, services, products and other work). Start with projects in which you are already creating Excel-based requests for expenditure - don't try to undertake everything at first - give yourself time to learn and optimize. (My mantra is “Do the basics well and then build out.”) You can forecast (via CA PPM Cost Plan) as a simple breakout by period of basic investment expenses you need to track, such as labor, hardware, software, travel, etc.

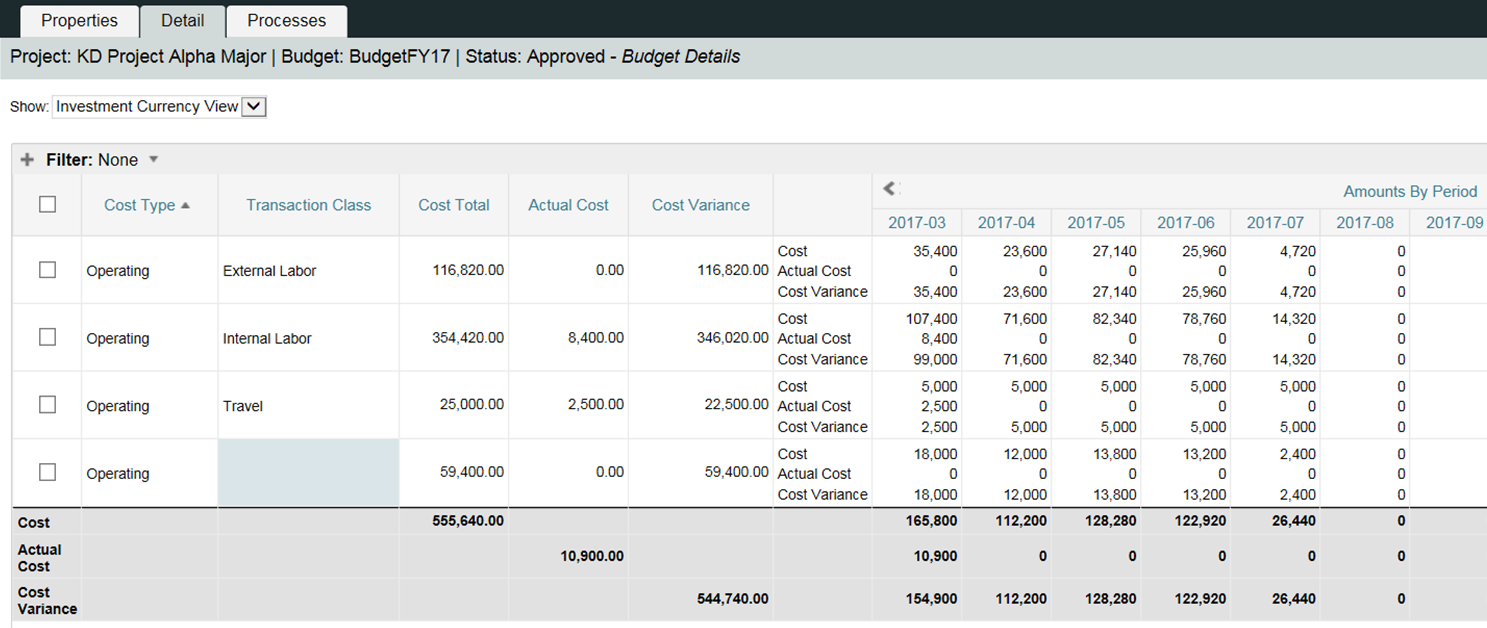

It is also important to capture an approved budget for tracking spend performance throughout each investment’s lifecycle. Forecasted spend may vary from month to month, but ideally not beyond the approved budget limit. CA PPM supports re-forecasting spend by period without touching the approved budget. During the open planning cycle, or as authorized by your organization’s change control procedure, you can submit a revised budget for the investment(s) for approval while retaining budget history.

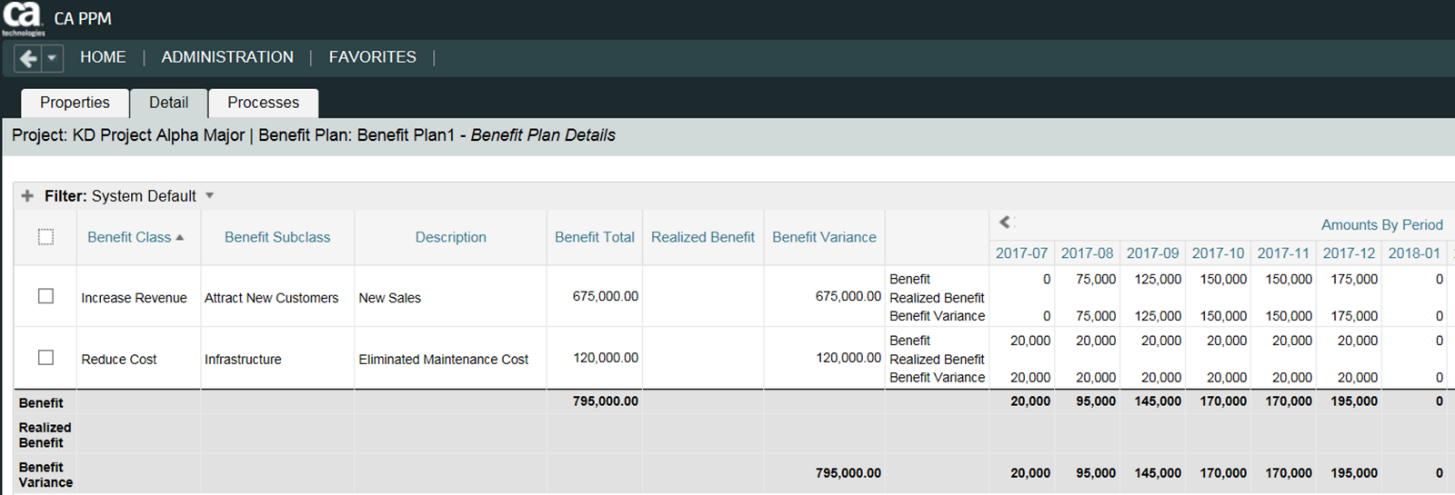

As your organization matures, you may also want to forecast expected benefits to be received from investments. This enables leadership to better assess expected return on each investment, a critical element of sound portfolio planning. You want to spend resources (money and people) on the right investments.

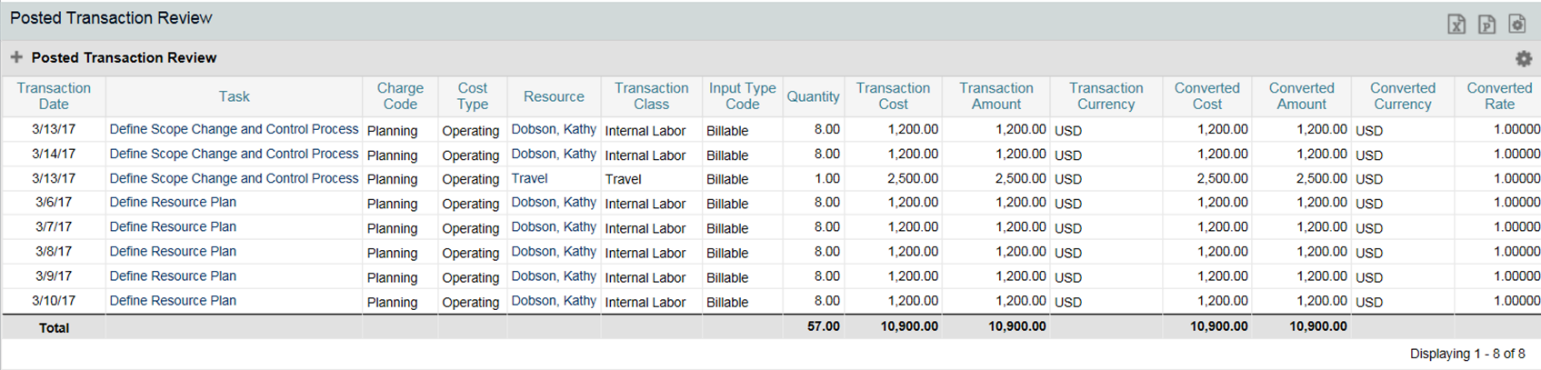

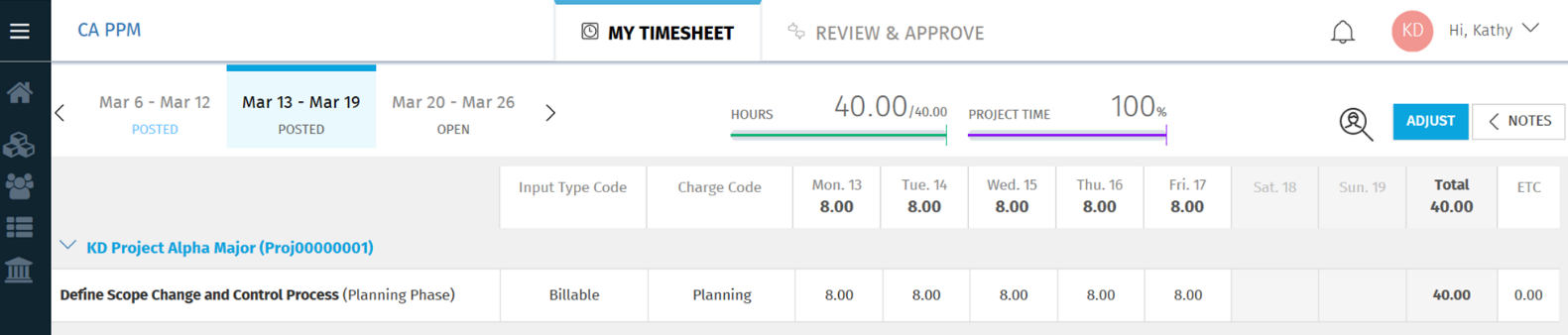

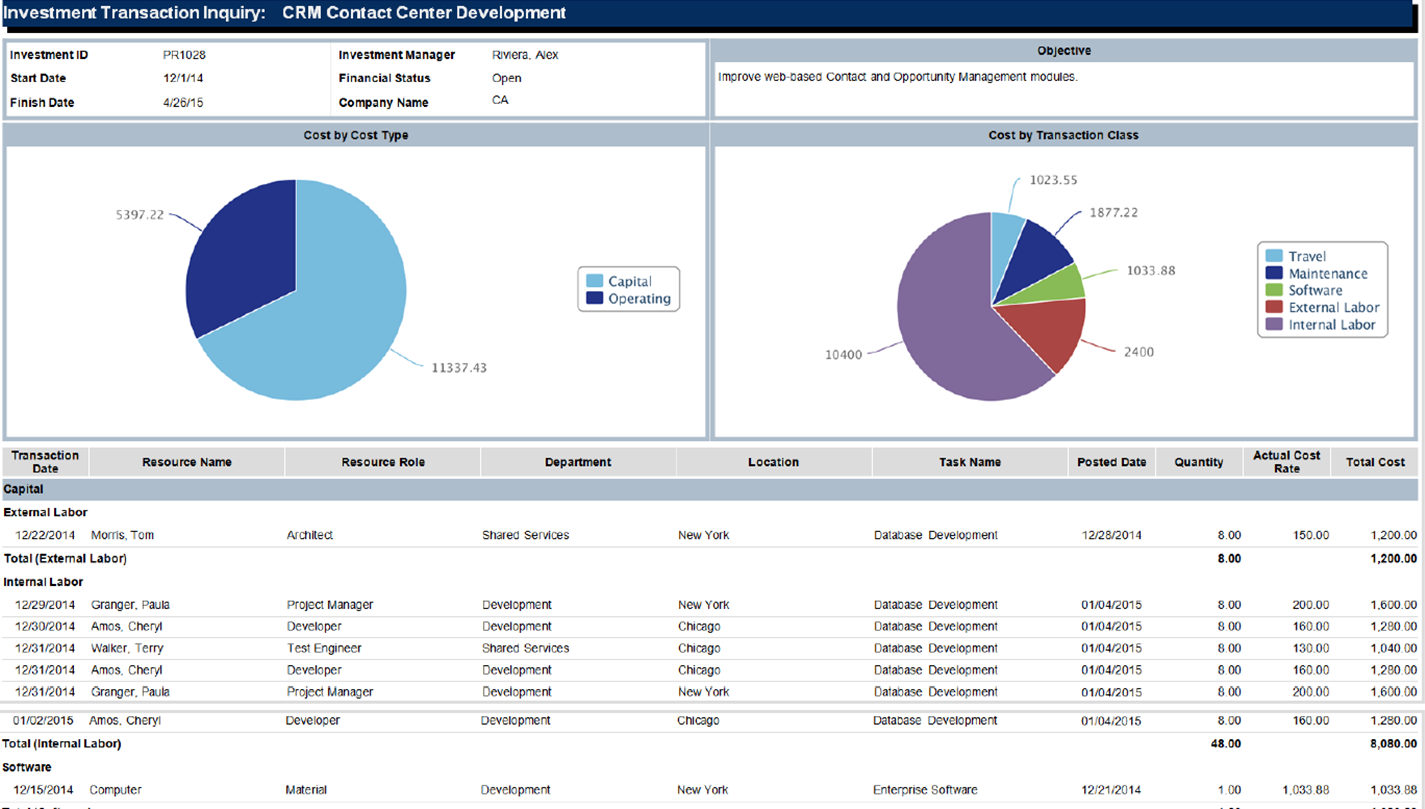

To maximize value from planning investment cost, it is important to track actual cost incurred by each investment (labor and non-labor expenses). Actual cost may come from time entry, manually entered actual cost transactions (via transaction entry) and/or transactions imported from an external source. Actual cost may be viewed from the Cost and Budget Plans as shown above and in other Portlets within CA PPM. Below is example of the investment Hierarchy view showing comparison of actual to planned, budget, and benefit. The second view shows a list of the detailed transactions making up the actuals posted against the investment.

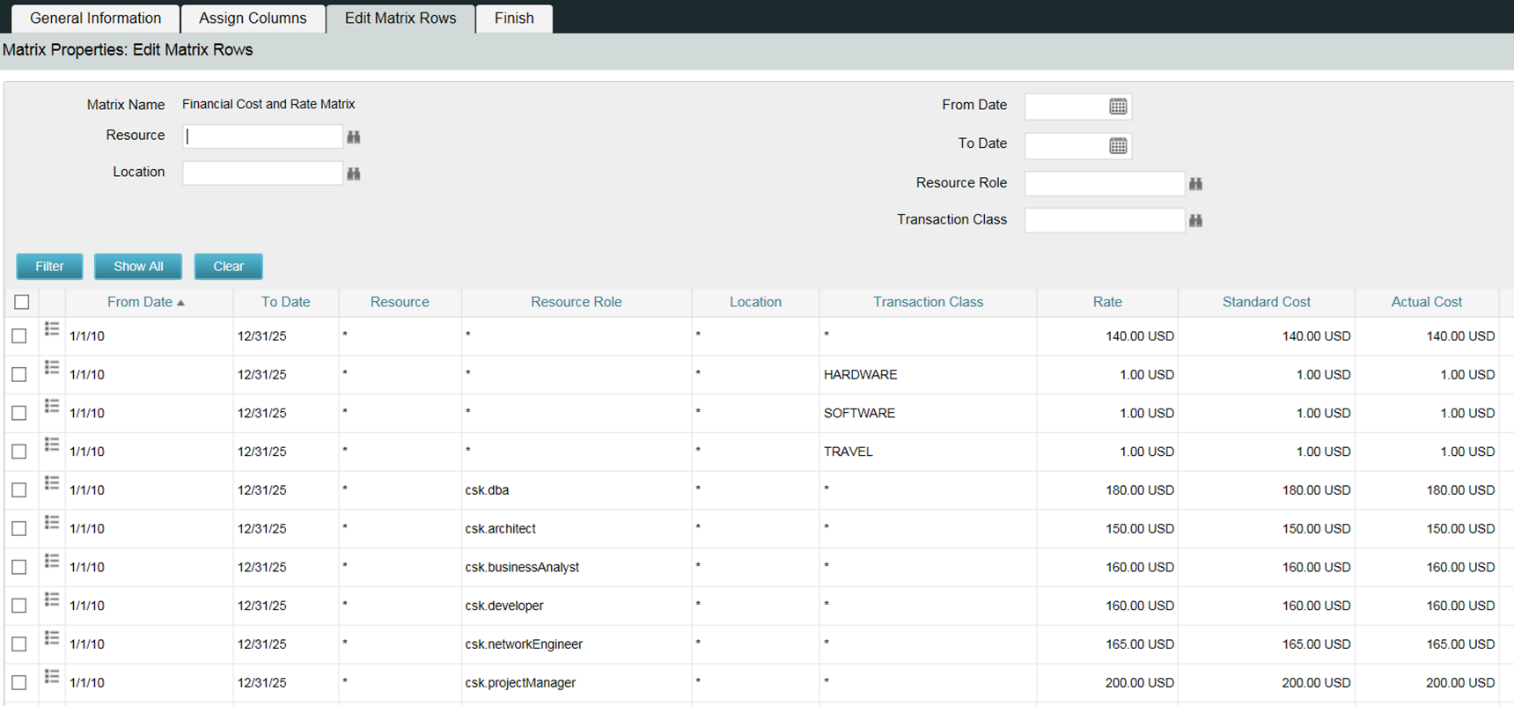

Pillar 1’s final element is a period-driven rate matrix (aka rate card) that defines how resources should be costed. This can be as simple as a single fully-loaded blended rate for internal resources or roles, or it can be broken out with different rates by type of resource/role, location, etc. The rate matrix is particularly helpful in automatically monetizing planned resource labor on investments for forecasting purposes, translating time entry into resource cost and/or costing out imported transactions.

Pillar 2 - Time Tracking

At first glance you may question why time tracking is part of financial planning. I’m glad you asked! Time tracking is the simplest way to capture labor cost on an investment, not to mention foundational to effective schedule management.

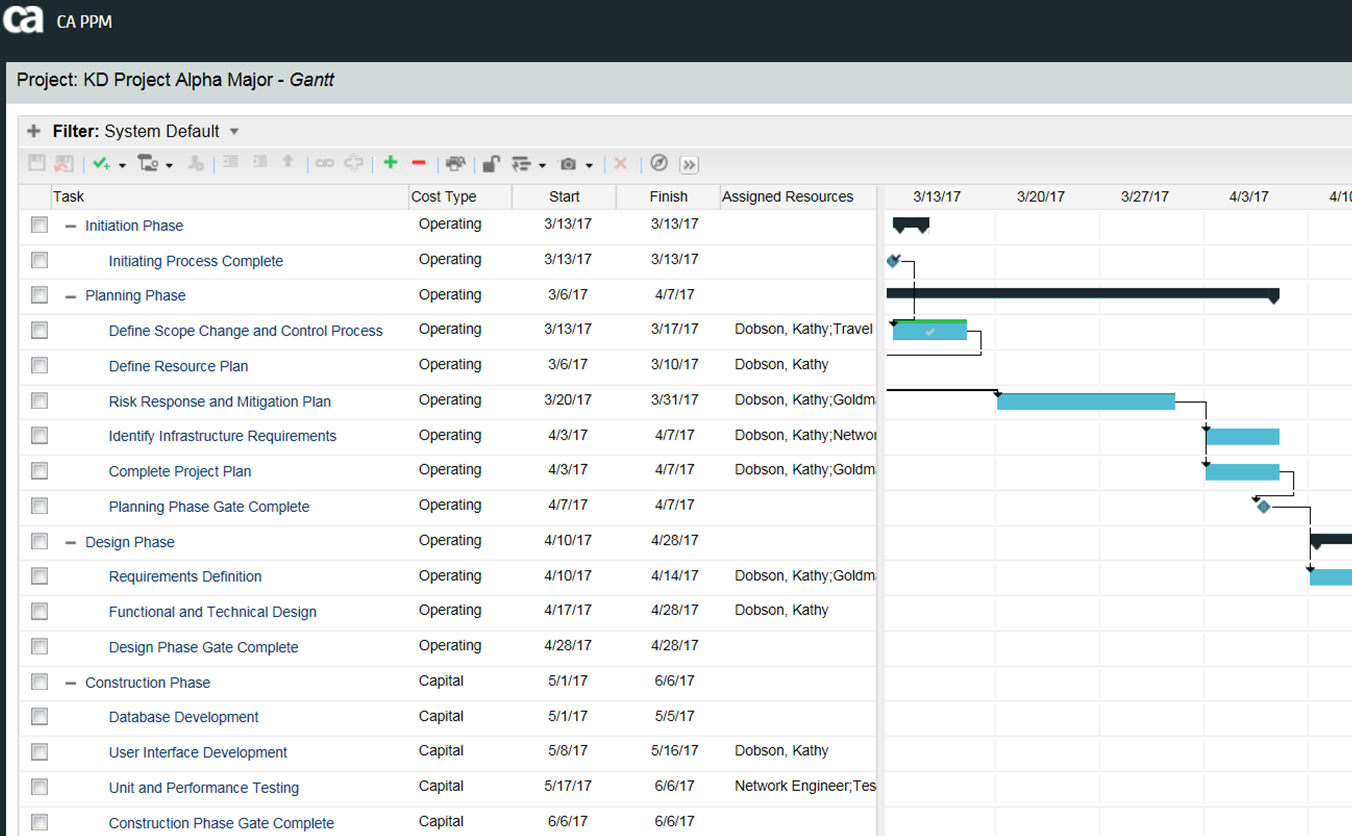

Pillar 3 - Capitalization

Many organizations need to track capitalized expenditures separate from operating expenses for financial reporting and compliance reasons. CA PPM supports this using the Cost Type feature. While there are various ways to do this, the most basic is to categorize costs as capital or operating by default at the project level (e.g., if the entire project is operational cost), task level (phase/type work varies between capital and operating) or team level, where each resource may specify a flat percentage of capitalization.

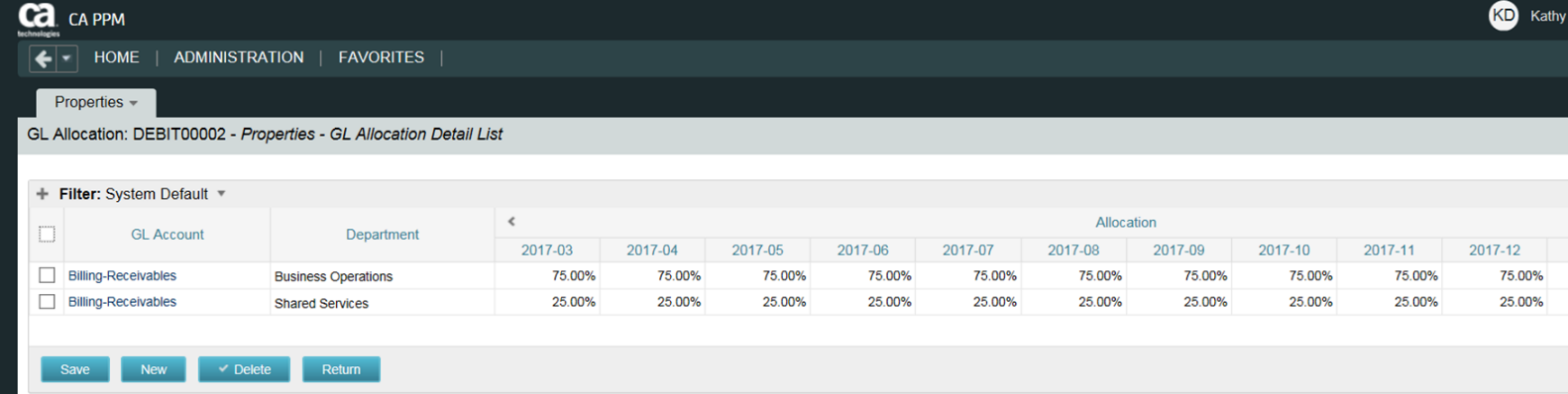

Pillar 4 - Cost Allocation and Recovery (Chargebacks)

CA PPM supports the ability to inter-transfer (allocate/debit) investment cost back to other departments for their share of the cost, for specific period(s), using the Chargeback functionality. A corresponding recovery (credit) is issued to the departments that performed the work. The debit rule for the inter-transfers may be set up at the system or investment level. Charges may be applied to a single department or spread across multiple departments by percentage and period based on qualifying rules. Credit rules are applied at the system level only.

Pillar 5 - Financial Reporting

Several out-of-the-box reports provide a great starting point for financial planning and tracking. Some reports enable planning or budgeting vs actual cost analysis, and others support capital/operating expense analysis. One report lists actual cost transactions by investment / resource / date. An exciting element since the Jaspersoft reporting engine was introduced in CA PPM 14, is the ability to easily create other ad hoc reports with the convenience of CA PPM Data Warehouse (DWH), which comes with ready-built domains for reporting and supports inclusion of custom attributes in DWH.

Coming Soon

In my next blog, I’ll explain the foundational financial setup, discuss the various classifications and show how they support financial planning.

Readers interested in more detail around CA PPM Financial Planning can check out DocOps. I encourage you to participate in the best-in-class site, where you have access to your peers, events and support. You can also reach out to CA Services for information about CA PPM and individualized business outcome references and analysis. Feel free to post in the comments section of this blog or contact me directly via email and Twitter @kdobsonppm.